Managing personal finances can often feel overwhelming, especially when you’re trying to balance living expenses, debt, and savings. The 50/30/20 rule is a simple yet powerful budgeting method that helps you allocate your income efficiently—without needing to track every rupee.

Whether you’re new to budgeting or looking for a simpler system, this guide will explain the 50/30/20 rule in detail and show you how to apply it with real-life examples.

What is the 50/30/20 Rule?

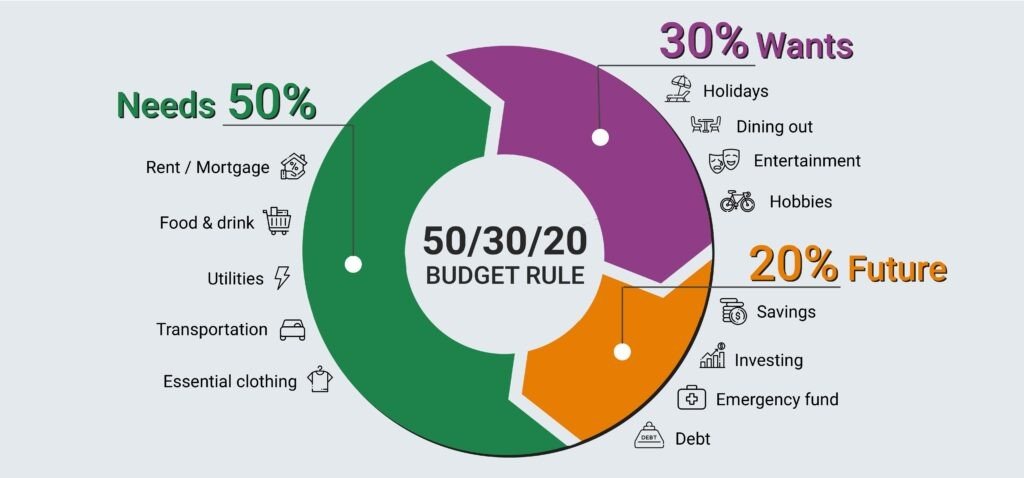

The 50/30/20 rule divides your after-tax income into three broad categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

This rule offers a clear and flexible structure to manage your money while still allowing room for enjoyment and long-term planning.

Let’s Break It Down

1. 50% – Needs

These are essential expenses that you must pay to live and work. This category includes:

- Rent or home loan EMIs

- Utilities (electricity, water, gas)

- Groceries

- Transportation (fuel, public transport)

- Insurance premiums

- Minimum loan payments

Goal: Keep these expenses at or under 50% of your income. If your needs exceed 50%, look for ways to reduce costs (e.g., moving to a more affordable location, using public transport).

2. 30% – Wants

Wants are lifestyle choices and non-essential expenses. This category is what makes life enjoyable but isn’t crucial for survival.

Examples include:

- Dining out

- Shopping and entertainment

- Vacations

- Streaming subscriptions

- Gym memberships (if not essential)

- Gadgets and luxury items

Tip: Be honest about what is a “want” versus a “need.” For instance, home internet might be a need for remote workers, but high-speed gaming internet may be a want.

3. 20% – Savings and Debt Repayment

This portion is for building your future financial health. It includes:

- Emergency fund contributions

- Retirement savings (PF, PPF, NPS, etc.)

- Mutual funds or SIPs

- Paying down existing debt (beyond minimum EMIs)

- Investing for future goals

Key Point: Always prioritize high-interest debt repayment and emergency savings first.

Real-Life Example

Let’s say your monthly net income is ₹60,000.

Needs (50%) = ₹30,000

- Rent: ₹15,000

- Groceries: ₹5,000

- Utilities & internet: ₹3,000

- Transport: ₹2,000

- Insurance & other bills: ₹5,000

Wants (30%) = ₹18,000

- Dining out & takeout: ₹4,000

- Shopping: ₹5,000

- OTT subscriptions: ₹1,000

- Travel & leisure: ₹8,000

Savings (20%) = ₹12,000

- SIP investment: ₹6,000

- Emergency fund: ₹3,000

- Debt repayment (extra): ₹3,000

This model keeps your finances balanced while also encouraging responsible savings and mindful spending.

Why the 50/30/20 Rule Works

- Simplicity: No need to track every expense

- Flexibility: Can be adjusted based on income level

- Balance: Covers essentials, lifestyle, and future planning

- Consistency: Helps build long-term financial discipline

Who Should Use This Rule?

The 50/30/20 rule is ideal for:

- Beginners learning to budget

- Salaried professionals

- Those looking for a low-maintenance financial plan

- Anyone trying to develop healthy money habits

If your income is irregular, you may need a more detailed or dynamic system, but the principles can still apply.

Final Thoughts

The 50/30/20 rule provides a smart, beginner-friendly framework to manage your money. By maintaining this balance, you can enjoy life today while preparing for tomorrow. Remember, the key is consistency and regular review. As your income or expenses change, adjust your budget to stay on track.

Disclaimer: This blog is for educational purposes only and does not constitute financial advice. Please consult a certified financial planner for personalized guidance.